Navigating a New Legal Landscape: Self-Driving Cars and Georgia Personal Injury Law

What once seemed like a futuristic pipedream is now a reality- The Insurance Institute for Highway Safety expects there to be 3.5 million vehicles with self-driving capabilities on the road by 2025. While this technological advancement promises greater convenience and safety on the roads, it also raises complex legal questions, especially concerning personal injury claims.

Understanding Self-Driving Technology

Self-driving cars, also known as autonomous vehicles, utilize advanced sensors, cameras, and artificial intelligence algorithms to navigate roads without human intervention. Tesla, a frontrunner in this field, has been developing its FSD mode, which aims to enable fully autonomous driving capabilities. While most major automakers’ new vehicles provide backup sensors, front crash warning systems, laser-guided cruise control and lane assist features to help cars remain in the correct lane, Tesla is the first to take the next step toward providing a truly autonomous vehicle.

Tesla’s Full Self-Driving (FSD) Mode

Tesla’s FSD mode represents a significant leap forward in autonomous driving technology. It incorporates features such as Autopilot, Navigate on Autopilot, and Traffic Light and Stop Sign Control. These features allow the vehicle to practically drive itself. Once engaged, the system will drive the vehicle with virtually no human intervention. It is capable of seeing and reacting to other vehicles on the road, changing lanes, reading road signs, obeying traffic lights, yielding to pedestrians, navigating to locations, and parking itself all without human intervention. While these features offer convenience and enhanced safety, they also pose two major questions: (1) are they safe and (2) what are the legal considerations in the event of accidents or injuries.

Are Autonomous Vehicles Safe?

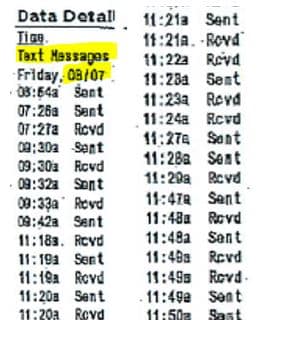

Determining the safety of autonomous vehicles is difficult because there is currently no reliable way to confirm whether a driver was using the automated driving mode at the time of a crash. However, most safety agencies agree that automated driving systems offer significant potential to reduce traffic crashes. The National Highway Traffic Safety Administration (NHTSA) of the U.S. Department of Transportation reports that 94% of crashes in the United States are caused by some sort of human error, with the leading causes being driving under the influence, distracted driving, and driving while tried. Therefore, the Department of Transportation found that automated driving systems “have the potential to significantly reduce highway fatalities by addressing the root cause of these tragic crashes.”

However, the question still remains as to whether these systems are “safe enough” to rely on for day-to-day use. I have spent the last three months driving a Tesla with Full Self-Driving capabilities and am not ready to say that it is “safe enough.” While I am, by no means, a safety expert, I can definitely say there were moments where, if left unchecked, the car would have caused a crash.

FSD technology does so many things well. However, there are certain situations where it fails miserably and others where it is just annoying. It fails miserably at seeing large white objects on clear sunny days. I have twice been in situations where I was stopped at a stop sign and the car almost pulled out directly in front of a large white vehicle crossing the intersection in front of me. Had I not been paying attention and disengaged the system, the FSD would have caused a crash in both instances. The FSD is annoying in the time it takes to make decisions in certain situations. At times, I can sense the car “thinking” about whether an action is safe. This feels like it takes forever and really slows down other traffic in the area. For example, when the car parks itself, it stops in the middle of the parking lot for a significant amount of time as it measures/plans its path to park. Also, when waiting to pull out from an intersection, the car will wait quite a while when there is no traffic coming to ensure it is safe to go. While these delays are probably safer, it does seem to cause congestion and annoyance to other drivers.

Despite my anecdotal evidence of issues with the technology, Tesla has published data showing that its FSD technology is safer than human driving. Tesla’s data reveals that it recorded one crash for every 7.65 million miles driven using its FSD technology, while the most recent data available from NHTSA reveals that, in the United States, there was one crash approximately every 670,000 miles driven. Thus, Tesla claims that its FSD technology is 1,100% safer than the average American driver.

Legal Implications of Autonomous Vehicles

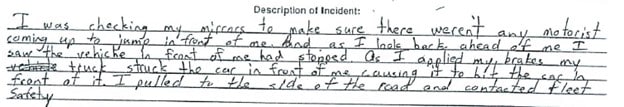

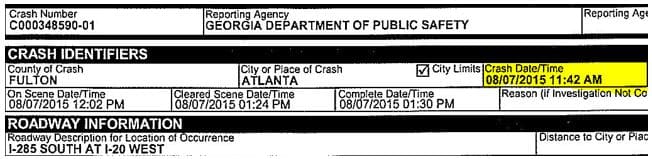

Determining liability in a crash involving an autonomous vehicle will likely be much easier due to the technology available on the vehicles. All autonomous vehicles are equipped with multiple cameras, which record and store data in real time. Therefore, after a crash, it is much easier for the responding office to pull the video from the car to see exactly what happened in the wreck and determine who was at fault. The driver of the autonomous vehicle is still responsible for the actions of the car; thus, fault would still lie with the autonomous vehicle driver even if the crash occurred while operating in self-driving mode.

The more complicated question involves insurance coverage. Who must pay for the crash? To date, Georgia law has not passed any statutes directly addressing insurance coverage as it relates to autonomous vehicles. Therefore, normal negligence and insurance law applies, which would make the driver of the at-fault vehicle and her insurance company responsible for the damage caused by the crash.

However, in a crash involving serious injuries where a malfunction of the autonomous driving software caused the crash, an injured party may be able to pursue a products liability claim against the manufacturer of the car/software. These cases can be complex; nevertheless, it is most certainly an avenue that an experienced personal injury attorney would explore should the facts warrant it.

The Rise of Robo-Taxis: What You Need to Know

Beyond individual ownership, the concept of Robo-taxis, or autonomous ride-hailing services, is on the horizon. Companies like Tesla and Waymo are exploring the potential for deploying fleets of self-driving vehicles for on-demand transportation. While this promises greater accessibility and efficiency, it also raises questions about insurance coverage, regulatory compliance, and passenger safety. Deploying these types of vehicles on Georgia’s roads will most certainly require new laws to determine what types of insurance coverage is required and who would be responsible for providing that coverage. Only time will tell how this plays out in the Georgia Legislature.

How to Protect Your Rights in a Self-Driving Future

In the face of rapid technological advancement, it’s crucial for individuals to stay informed and proactive about their legal rights. If you’re involved in an accident involving a self-driving car, here are some steps to take:

1. Seek Medical Attention:

Your health and safety should always be the top priority. Seek medical attention for any injuries sustained in the accident.

2. Document the Scene:

Gather evidence, including photographs of the accident scene, vehicle damage, any relevant road conditions, and check with the autonomous vehicle driver to see if there is video of the crash.

3. Contact Law Enforcement:

Report the accident to the police and obtain a copy of the accident report.

4. Consult with an Attorney:

A skilled personal injury attorney can help preserve evidence, assess your case, advise you on your legal options, and represent your interests in negotiations or litigation.

Conclusion

Self-driving cars hold the promise of a safer and more efficient transportation future. However, as with any technological innovation, there are legal considerations that must be addressed. By understanding your rights and seeking knowledgeable legal representation, you can navigate the complexities of personal injury claims in the age of self-driving cars. The experienced personal injury attorneys at Williams Elleby Howard & Easter work hard to get accident victims the compensation they deserve.

Located in Kennesaw, Georgia, Williams Elleby Howard & Easter serves clients throughout the State of Georgia. If you or a loved one suffered an injury as a result of a autonomous vehicle, Attorney Jared Easter at Williams, Elleby, Howard, & Easter can help you understand what possible claims you may have and work to get you the compensation you deserve. To schedule a free consultation, call 833-534-2542 today.